CERA argues that “It is not helpful to couch the debate in terms of a superficial analysis of reservoir constraints…..based on a range of potential scenarios and field-by-field analysis, CERA finds that not only will world oil production not peak before 2030, but that the idea of a peak is itself a dramatic but highly questionable image.”

“It is no longer sensible to allow the issues about future supplies to be clouded in a debate grounded in a flawed technical argument,” the CERA report concludes.

Will CERA now also accuse Peakists (as it calls) of being a treat to global energy security?

There are already many reactions to CERA’s report. You can find almost all at http://www.energybulletin.net/ . So, I will try to avoid repeating them.

But, I would like to point out a few points to demonstrate it is indeed CERA’s analysis that is flawed, ungrounded, and questionable.

1. CERA’s flawed definitions:

CERA states that “Non-traditional or unconventional liquid fuels such as production from heavy oil sands, gas-related liquids (condensate and natural gas liquids), gas-to-liquids (GTL), and coal-to-liquids (CTL) will need to fill the gap.”

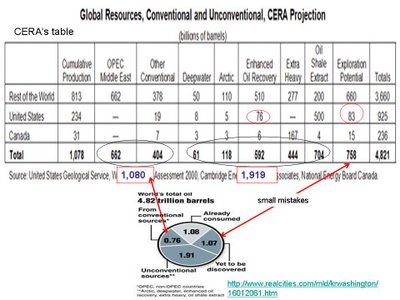

Moreover, CERA claims that the use of only proven remaining reserves of conventional oil ignores “the enormous contribution likely from probable and possible resources, those yet to be found, and plays down the importance of unconventional reserves in the Canadian oil sands, the Orinoco tar belt, oil shale and GTL projects. CERA believes the global inventory is some 4.8 trillion barrels, of which about 1.08 trillion barrels have been produced, leaving 3.72 trillion conventional and unconventional barrels, an order of magnitude that will allow productive capacity to continue to expand well into this century.”

The following table is from CERA. (by the way, A chart displaying the aggregates of that table, which I don’t know whether it is in fact in the report, makes some small mistakes. Oh well, that happens.)

Now, can anyone show me where those unconventional gas related liquids (condensate and natural gas liquids) are in that table? Well, at least for the US I can say that they are lumped in conventional oil. For the others? Does CERA play apples and oranges game here?

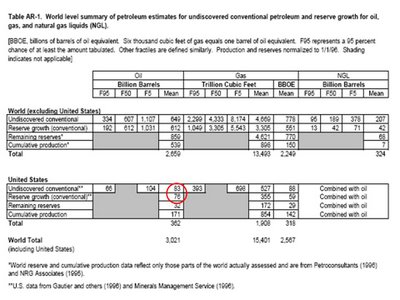

2. If CERA has such a great database and technical knowledge why it uses USGS undiscovered oil resources and reserve growth figures (at least for the US), which are based on 1995/1996 data and analysis? Were there no discoveries in the US in the past 10 years?

Below is the Table AR-1. World level summary of petroleum estimates for undiscovered conventional petroleum and reserve growth for oil, gas, and natural gas liquids (NGL). From USGS 2000.

3. Now let us see what Peter Jackson, the same CERA author who wrote that 16 page report attacking Peak Oil (also the author of CERA’s World Liquids Capacity Outlook to 2010: Tight Supply or Excess report) wrote in the February 7, 2006 issue of the Wall Street Journal CERA had a special advertising section.

“Oil is a finite resource, and although there is still no reliable estimate of ultimate global reserves, there is a fixed amount of it in the ground. ….In recent year we have more than replaced global annual production through exploration and field reserve upgrades….We see no evidence to suggest a peak before 2020, nor do we see a transparent and technically sound analysis from another source that justifies belief in an imminent peak.”

No peak before 2020 announced in February 2006, became no peak before 2030 in November 2006. How credible is that?

4. CERA authors and Mr. Yergin must (re)read some articles of King Hubbert.

Look at the CERA’s “conventional oil” curve below. That curve is not an alien to Peak Oil Theory. Even the unconventional oil part is not alien. Aren’t those curves show that after a point production does not increase anymore, and eventually decline? Is that different from what Peak Oil Theory says?

5. In CERA's figure cumulative production up to 2070 is 2.93 trillion barrels. This means that the amount consumed between 2000 and 2070 (in fact maybe they really meant 2005 and 2070) is 1.93 trillion barrels (2.93 less 1).

Now, go back to CERA’s table. Calculate conventional reserves plus exploration potential (1.080+0.758 = ) is 1.838 trillion barrels. So, by 2070 we will have consumed 1.93 trillion of available 1.838 trillion barrels of recoverable conventional reserves. This means at that time we would be already in deficit of nearly 0.1 trillion barrels. But according to CERA in 2070 we would still produce 70 million barrels of conventional oil per day. Is that CERA’s voodo calculations orI am doing something wrong? [thanks to a comment for pointing out my mistake before]

Was James Burkhard (another CERA director) meaning something in that line when he said “Today’s distant future may not be tomorrow’s.” Oh, this sentence was in the same Wall Street Journal Ad of CERA.

Conclusion

CERA should look at itself before criticizing Peak Oil. CERA’s tango with Peak Oil may bring more popularity and money to CERA. But wolves are watching and waiting for the last tango!

Peak Oil

CERA

I'm a regular reader. Good blog. Thanks. Keep it up.

ReplyDeleteI will try to link to some of yr pieces /or just blog / where appropriate.

best

Ana

I'm not sure I understand point 5.

ReplyDelete1.07 + 0.76 = 1.83 is less than 2.93 - 1.0 = 1.93

so according to your interpretation of the CERA graph, that 0.1 trillion is not what will be left in 2070, but what will be in deficit. To confirm this, I tried to estimate the area under CERA's conventional oil curve. It has a mean somewhere between 75 and 90 million barrels per day (or 0.025 to 0.033 trillion barrels per year) for 70 years = 1.9 to 2.3 trillion barrels.

So it looks like all the conventional oil will be gone before 2070 when we will indeed be in deficit.

I apologize for the bad math. Yes, we will be in deficit. Thanks a lot for pointing it out.

ReplyDeleteIt appears the graphic and the table in CERA's presentation transposes the numbers for the amounts of oil in "yet to be discovered" and "conventional."

ReplyDelete"Convential Resources" resources in the table is 1,070 Bn barrels while in the graphic 1,080 bn barrels are in the "yet to be discovered" catagory.

"Exploration potential" resources in the table are 758 Bn barrels while in the graphic "From Conventional Sources" resources are 760bn barrels.

Both numbers of potential resources sums exactly to 3.74 trillion barrels.

Blame a non-attentive analyst for confusing the two numbers -- it seems to me that the table holds CERA's "true" projection of future resources.